PwC’s 2018 Global Economic Crime and Fraud Survey describes fraud as “the biggest competitor you didn’t know you had.” For any organisation, this sounds alarming indeed. Like competition in industry isn’t hard enough. However, at least it’s a competitor that you might have some control over.

It follows that corporate fraud awareness and prevention training could actually be viewed as a contributor to business development. The level of fraud training that employees are required to do, and the importance placed on it, will usually come down to an organisation’s size and the industry in which it operates.

The cost of fraud

Fraud doesn’t just happen in financial services. PwC’s report surveyed organisations across the globe and recognised that fraud is now a big business in itself being “tech-enabled, innovative, opportunistic and pervasive.” And it didn’t just take into account the direct losses from fraud.

The report stated that 46% of respondents said their organisation spent the same or more on investigations and other interventions than was directly lost to fraud itself.

42% of respondents said their companies had increased spending on combating fraud and economic crime over the past two years.

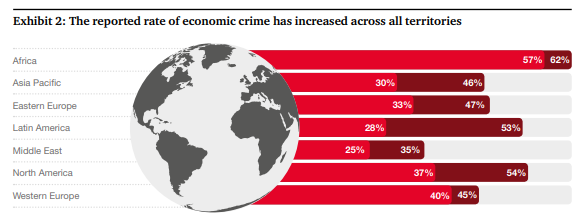

And in all global territories, the reported rate of economic crime over the last two years has increased.

So in some regions, economic crime has almost doubled, yet the spending on preventing fraud and economic crime has increased. What’s going wrong?

Depending on the type of your organisation and the industry in which it operates, there will be different levels of opportunity for fraud for employees. It’s unlikely your organisation is harbouring a Bernie Madoff. It’s equally unlikely your CEO has Al Capone’s money laundering ambitions. But the statistics are clearly showing a rise in economic crime, so it’s simply not an area that Leadership teams can ignore.

Fraud - No great myth-tery

The Fraud Triangle

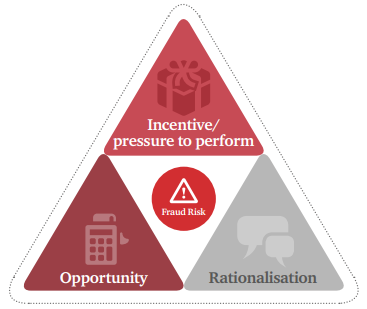

Cressey’s Fraud Triangle can help explain the reasons why fraud might occur. With the “right” balance of Opportunity, Perceived Pressure/Motivation and Rationalisation, it shouldn’t come as too big a surprise that an employee might consider committing a fraudulent act, particularly a seemingly small one.

There’s an 10-80-10 theory bandied around the Fraud Prevention industry. It claims that 10% of people will never steal or commit fraud, 80% of people may or may not commit fraud depending on how they rationalise it, and 10% will steal at any available opportunity. That almost seems unbelievable. It suggests that you can look at your workforce and think.. “I can only fully trust 10% of these people.” Woh.

Even taking that theory with a pinch of salt, if you understand something of human nature when it’s faced with pressure, opportunity and an amazing ability to justify behaviour, we can accept that no amount of training will completely stop different types of fraud.

We also know that it is at best, remiss and at worst, negligent, to ignore fraud or theft as a potential issue in an organisation.

A 2018 fraud report from the Association of Certified Fraud Examiners in the US noted that 53% of reported fraud via tip-offs - the most common means by which fraud was detected - were provided by employees of the victim organisations. This being the case, it is clearly worth having a workforce that recognises fraudulent activity and feels empowered to report it.

Fraud Training - no excuses

For most organisations, fraud training usually comes under the banner of Compliance. Thankfully in these modern times, compliance training doesn’t have to be dull, tedious and - let’s face it - an utter waste of employees’ precious time.

There are lots of options available that make use of new Learning Experiences Platforms, games and apps, and solid learning principles for engagement and knowledge retention. These provide real opportunities to counter fraud in the workplace. You can equip employees with the relevant knowledge to recognise potential fraud, and give them the confidence to act appropriately when fraud is evident.

Sophisticated analytics can now be gathered that highlight specific knowledge gaps in topics or situations. They can identify problem geographical areas or specific individuals - from the experts to the could-do-betters to the walking liabilities. Adaptive learning systems, like our Verify service, can target these individual knowledge gaps and serve up the precise learning that’s needed to fill each learner’s gaps.

The analytics demonstrate solid proof for regulatory bodies and law enforcement agencies that adequate training is being prioritised. This data can also help with ongoing risk management, as competence and confidence can be tracked and monitored.

Topics included within fraud awareness training offered at work will also be relevant to employees’ lives outside of work. Employees will realise they have a vested interest in gaining a level of fraud awareness There’s everything to be gained by knowing how to protect our own personal information and our money.

Fraud awareness training for employees: 3 great options - 3 less excuses

In a nutshell, employees who are well trained in fraud awareness should at the very least be able to (a) identify fraudulent activity and (b) respond appropriately. You can choose from a number of solutions to best achieve these objectives, and if necessary, tailor it further to make it as specific as required. Here are 3 options that can effectively help you raise awareness of fraud:

- Traditional online learning

If you opt to deliver an online fraud training course by traditional methods, it doesn’t have to bore your employees. Incorporate a quality fraud training course into your fraud awareness initiative. Choose one that will engage and resonate with employees, through course content that is relevant and practical, bundled up in a modern consumable learning experience. - Game/App

Through a fun and visual game, engage your employees in the key points of fraud prevention. Complement existing training by reinforcing the important information, or embed the things worth remembering by building them into a game. Try our Fraud Awareness game here. - Spaced practice through microlearning

Take a whole new approach to embedding critical fraud prevention knowledge through a spaced repetition solution. See how a Verify solution can identify the knowledge gaps and automatically reduce them over time. No do-it-and-forget-it. This adaptive, engaging solution requires that employees continually demonstrate competence and know-how. And - you get a set of advanced analytics that will delight any regulator.

Watch the video below to see how the Verify RapidScan tool can pinpoint knowledge gaps. Get a free trial of the Verify RapidScan for your organisation.

Beyond the fraud numbers

It’s perhaps a point worth making that - even with the advanced data analytics available - a good fraud prevention training initiative has value beyond the statistics of learning. By putting importance on fraud awareness training, you create an opportunity to embed values around honesty, and an expectation of moral behaviour and high personal standards. Incorporating nudge tactics and positive reminders within any fraud training can further encourage an open and honest culture that employees can rise to be a part of - surely a powerful asset in preventing fraud.

Don’t wait for a Fraud Awareness week (International Fraud Awareness Week) to reduce your fraud risk. Many types of fraud can occur in the workplace including identity fraud and cyber crime. Please contact us to talk about how we can help you to create the greatest weapons in the fight against corporate fraud - an anti-fraud culture and an informed, empowered workforce.

Before you go - read our other compliance blogs

All the GDPR checklists you'll ever need

https://blog.logicearth.com/all-the-gdpr-checklists-youll-ever-need

Diversity and Inclusion at work

https://blog.logicearth.com/diversity-and-inclusion-at-work

Seeing red with compliance training

https://blog.logicearth.com/compliance-training-what-is-it-for

Corporate fraud training - no excuses

https://blog.logicearth.com/corporate-fraud-training

Was this article helpful?